The CTV Trends We’re Seeing for 2024

March 11, 2024

Investment in CTV is {STILL!} ramping up

Global CTV ad revenue is expected to reach $29.6 billion in 2024. That’s up from nearly $26 billion this year, or over a 14% increase. And by 2028, CTV ad revenue is expected to grow to at least $42.5 billion. Almost double what it was in 2022.

Ad spend on CTV is growing by double digits every year, outpacing every other major ad format, including social media, paid search, and email. Only retail media’s growth will outpace CTV in the future (but we’ll get to that later).

Around 88% of households now have one internet-connected TV device. That includes, increasingly, the homes of Generation X and Baby Boomers users that are increasingly drawn to CTV channels to supplement, or even replace, their dominant linear TV viewing. – It’s shaping up to be a good year for this marketing channel. Let’s get into the predictions we have for CTV in 2024.

CTV ad spend outpacing linear and almost every other channel

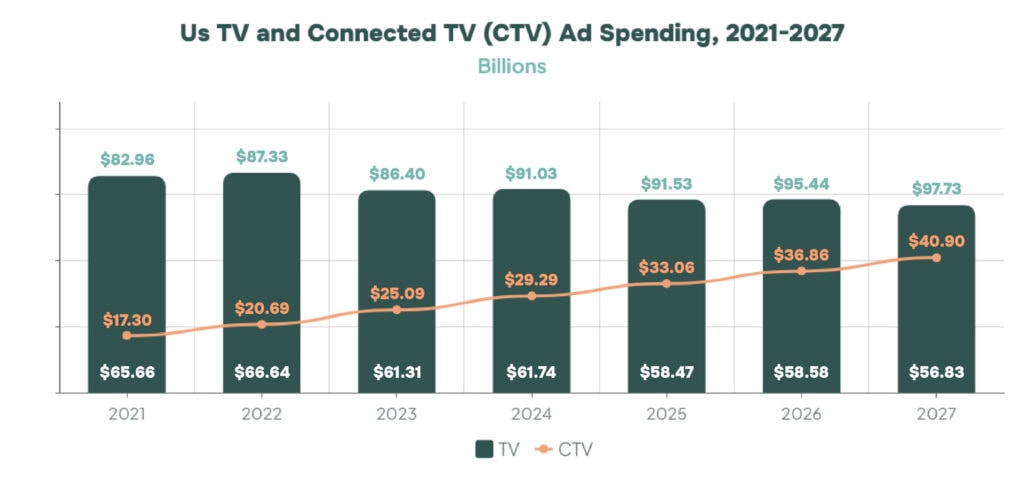

The share of CTV in total ad spend in the US? Around 5%. But by 2027, CTV ad spending is expected to make up nearly 8%.

One in four ad dollars already goes to television, whether that’s linear, cable, or CTV. And over time, more of those dollars are getting shifted to CTV, as linear advertising continues to decrease year-by-year. And yet even as linear TV spend is falling, CTV spend is going up at a faster rate: meaning that TV spending is making net gains overall. As it stands, CTV ads have a large market to inherit from their linear predecessors.

Not only is CTV overpowering linear, but it’s beating expectations across the board. CTV is also outpacing social ads, SEO, and every other channel–that is, besides retail media.

Retail and CTV: A perfect match for shoppable media

The only channel to match the speed of CTV growth is retail media. In fact, retail media is predicted to surpass TV spending entirely by 2028. Ad revenue from retail media was expected to grow 9.9% this year. In 2023, retail media has become the second fastest growing channel, behind CTV. Starting in 2024 and through 2027, however, it’ll be the fastest growing, and that opens the door to new partnerships in the CTV space.

Before we dive deeper into the connection between retail media and CTV, let’s define what retail media is. In a nutshell, retail media is the process through which companies like Walmart and Amazon (and other big retailers–grocery chains like Sprouts and electronics companies like Best Buy, for example) lend their first-party data to other, smaller retailers to list sponsored goods on their websites, whether natively or as banner ads. These bigger retailers both charge for the advertising and earn a commission on each item sold. The partnerships created form retail media networks, or RMNs, which have become the backbone for an ever-expanding market protected against both the degradation of third-party data and compliant with regulations surrounding such data. Essentially, it’s a win-win for the big and small retailers. In fact, nearly 40% of retailers in the US are offering inventory through their RMNs.

Where does CTV come in? Well, these RMNs can also lend their first party data to CTV advertisers, which leads directly to the advent of shoppable CTV ads. Now, viewers can make purchases with the push of a button on a TV remote.

Combining the data from RMNs, things like preferences of buyers and details of transactions they’ve made, with data gathered from CTV on viewership expands the reach of targeted, upper-funnel ads (as opposed to the lower-funnel ads targeted to customers already shopping on company websites like say, Macys.com).

Last year, Roku struck a partnership with Walmart, delivering ads from Walmart’s RMN to Roku devices … the first to do so. However, that was only the beginning: Roku has further partnered with Best Buy, Instacart, and The Kroger Co. (which also made a deal with Disney this April). Walmart also struck a deal this year with NBCUniversal–and let’s not forget Amazon, which, because it has its own streaming platforms and the largest RMN of them all, will begin introducing ads on Prime Video in 2024.

According to Insider Intelligence, the combo ad spend for retail media on CTV will add up to $813 million this year, but by the end of 2027, it’ll increase over tenfold to $8.64 billion by 2027. In 2024 alone, ad spend for retail media-CTV is expected to increase to $3.63 billion. – The future is bright for shoppable media.

FAST channels are ramping up

The FAST channels (RokuTV, Tubi, Samsung, and more) will continue to grab a bigger piece of the pie when it comes to CTV watch time. And because the channels are completely ad-supported, as they grow, they will command a bigger budget of CTV advertising.

Like YouTube, which commands a large portion of CTV ad revenue–and the highest watch time among streamers as of September–these FAST channels have the advantage of being absolutely free, and additionally replicate the experience of linear channels in many cases, becoming the lowest barrier for entry from the linear TV market. You don’t even have to sign in.

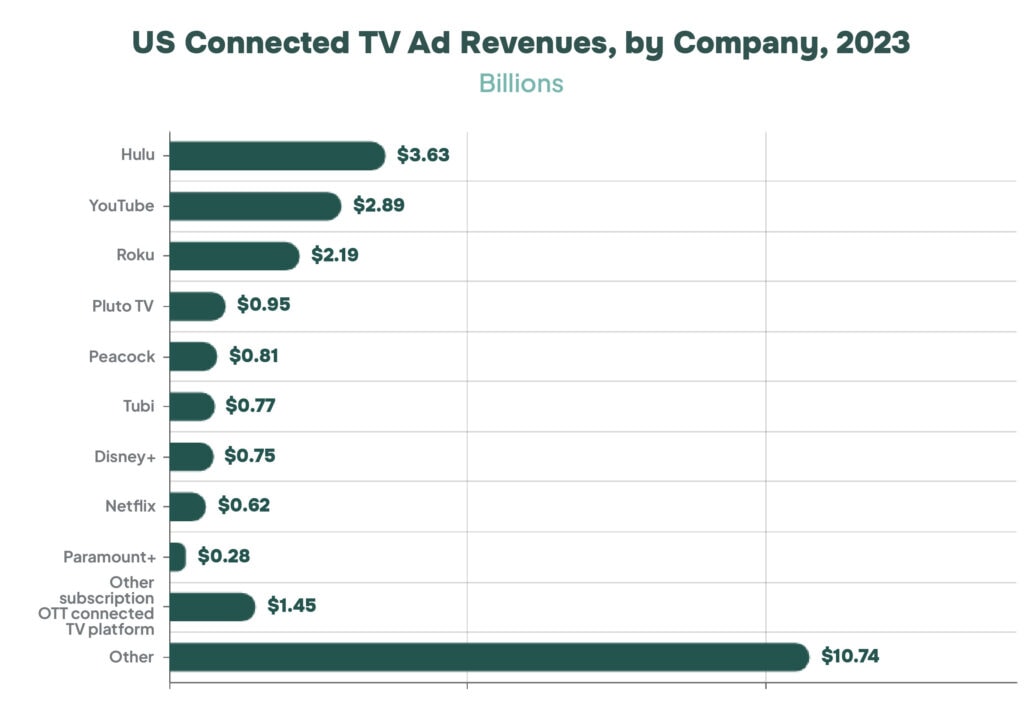

And as FAST channels command more of viewers’ attention, they single-handedly increase ad spend in CTV programming–following fast on the tails of Hulu and YouTube in terms of ad revenue.

In terms of ad dollars, Hulu commands the most, despite being the fourth most watched SVOD channel. It’s followed by YouTube and then by FAST channels Roku and Tubi–even though they come in eighth and sixth in terms of viewership. Disney and Netflix trail in ad dollars, even though Netflix is the second most-watched streaming service.

Tubi and the Roku Channel saw lifts in viewership throughout 2023–and the trend is expected to continue into 2024. Next year, FAST viewers are expected to reach nearly 105 million, while those with ad-supported subscriptions are expected to reach slightly over 180 million, according to Insider Intelligence.

Altogether, ad-supported streaming (AVOD) is expected to generate $10 billion in revenue by 2027.

Ad-supported tiers set to win (especially among older generations)

When Netflix and Disney added ad-supported tiers late last year, the lower price to entry encouraged new users to try out the services. While it’s harder to convert ad-free customers to transfer to ad-supported services, many have made the switch because of the cost savings–and with Netflix removing its lowest-priced ad-free tier just this year, more users are incentivized to choose their much lower priced ad-supported option.

Bob Iger, CEO of Disney, said that of the new users subscribing to Disney+, 40% were choosing the ad-supported tier. And Netflix’s group of ad-supported users has increased to over 15 million viewers a month.

As streamers continue to push users to the less-expensive (for the users) and more-lucrative (for the streamers) tiers, some demographics find they actually prefer the cheaper ad-supported content.

Baby Boomers are more likely to prefer ad-supported tiers. According to one study, older generations, especially those over 50, are more inclined to watch ad-supported streaming services rather than their more costly ad-free counterparts. With viewers over 50 surpassing the 35-49 year age group in watch time for the first time this year and accounting for almost 40% of streaming altogether, FAST has a growing market ahead of it.

Programmatic ad spend increasing

CTV is the biggest channel to use programmatic ad spend–this year, it accounted for nearly 90% of CTV display ad spending at $21.52 billion. Compare that to 2019, when it was only $5.76 billion. It’s also grabbing up some of the linear TV market, making up 10% of ad spend.

Marketers are expected to continue to combine the power of data-driven marketing and the benefit of personalization to target viewers programmatically in 2024–both linearly and on CTV. Using audience segmentation that goes beyond just age and gender is on the minds of both CTV and linear advertisers.

Sports: the final frontier

Sports broadcasts continue to command TV audiences: within August, September, and October 2023, users drifted from CTV to linear to watch sports, particularly NFL games. It’s not all bad for streamers, however.

Prime Video saw a bump in viewership in September because of its exclusive rights to NFL Thursday Night Football, contributing majorly to its 7.5% viewership increase. The highest viewing days for Prime Video these months were the two Thursdays with NFL games.

The NFL, which commands the most viewers across cable, is still locked up on cable and broadcast networks for the next decade. But YouTube and Prime Video’s small share in NFL broadcasting rights bodes well for the future of CTV sports streaming. And come 2033, the tides may shift further in favor of streaming.

Many games on linear continue to be streamed online, too. And streamers are eager to jump into the arena and take over live sports broadcasting themselves. For example, live sports is coming to Netflix via “The Netflix Cup ” which purports itself to be a combo Formula 1-and-golf competition. Hulu streams NHL hockey games. Max is offering five-month free access to its collection of live sporting events which include MLB, NBA, NHL, and U.S. national soccer games. YoutubeTV has the rights to the NFL Sunday Ticket, and of course, Peacock and Paramount+ are also involved in live sport streaming, from their respective NBC and CBS linear channels.

Of the 8.9 billion dollars spent on advertising, a whopping 73% still goes to broadcast and cable TV. The difficult to attribute, expensive channel still commands a lot of money–but slowly and surely, as sports is broadcast concurrently on linear and CTV channels, the advantages of CTV targeting will help streaming rise to the top.

2024 is CTV’s year

CTV still has a lot of growing to do. But so far, it all signals point to increased revenue, further reach, and more advanced targeting and attribution. CTV is extending into avenues that speak to its promise and creative applications–shoppable media for one, and partnerships like that between Spotify and Roku to play CTV ads breaks on TV screens using Spotify–adding audio-visual content to a primarily audio-only format.

Where else will CTV go? Some we can anticipate–like generational viewership and the adoption of FAST channels. For others, we’ll have to wait and see where the advancements of CTV take us.